A Change in Our Conversation – Fiscal Responsibility

by Josh Loveless

As many of you know (welcome to those who don’t), I am running for a seat in the U.S. House of Representatives. If you’ve been listening to me recently, or over the years, I have loudly proclaimed a need for a “Change in Our Conversation” at the national level. I wanted to take the time to tell you what I mean by that statement, and fiscal responsibility is a good subject to illustrate the point.

In the 2012 Presidential election cycle we heard many speeches about our national economy and taxes. Many ideological theories on how to fix our looming financial problems were discussed incessantly. Most interestingly after all this discussion, we the people voted for the status quo. We changed neither our President, nor our Congress. Why?

It is my opinion the outcome was determined by the conversation. In all the debates and campaigning most Americans found that there was plenty of flowery language, incisive catch phrases, political platitudes and a general pandering tone in the arguments of both sides. Essentially what we got was a total lack of reason and common sense delivered in a shiny feel-good (or outraging) wrapper. The inner product contained little substance.

The Democrats would have us believe that the ideas of many Republicans are worn-out, tired, and failed. The Republicans would have us believe that the Democrats are proposing more reckless policies that lead us to our current predicament in the first place. But neither side really offered any real solutions. Instead they repeated the same talking points they’ve been using for years, but with different branding.

An example would be how the Democrats realized that the term “pro-choice” was to some inflammatory and non-inclusive. They changed the brand; instead they now call pro-choice “reproductive rights”. Who’s not for the right to control our own sex-lives and ability to make choices around procreation? At the root however, the substance of the argument did not change.

We need to stop changing our brand or our slogans and instead change the conversation. We need to return to talking about substance. We need to talk about the hard truths, roll-up our sleeves and go to work. We need a return to action. It’s not enough to offer platitudes and campaign promises. We require a president and a congress that is willing to concede the root of a problem; who lock themselves in a room until they agree on a tangible solution that is balanced, responsible, and appropriate (even if it isn’t politically expedient).

Take fiscal responsibility for example. We have spent the last 60 or more years ignoring three immutable facts: 2-1=1, 1-1=0, and 1-2=-1. You don’t need to read Adam Smith, have a PhD in economics, or be a captain of industry to understand that spending more than you take in leads to bankruptcy. Math is not an old, tired out political idea. One plus one never equals 11.

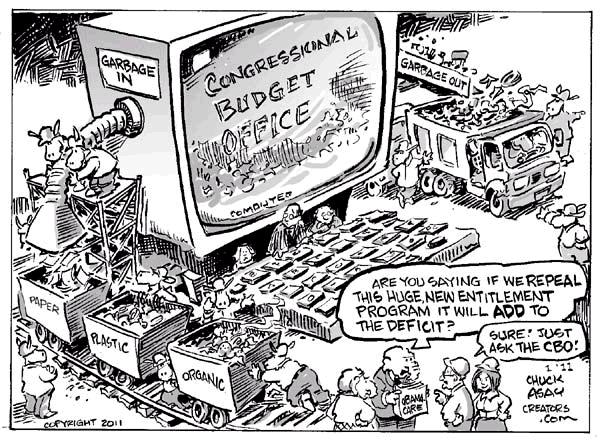

This statement is not a philosophical one. Nor is it one of morality, religion, ideology, or politics. Our political class however will go to nearly any length to obscure the truth and make it seem so. They will charge the conversation with rhetoric but they never address the root except in divisive passing acknowledgement.

It’s not enough to acknowledge the problem. We require a solution, one that is realistic and workable. We require a return to common sense. We require a conversation about the root of the problem. Again, take into consideration our prevailing conversation on taxation.

Listening to either side of the “fiscal cliff” argument one gets a very clear picture: Taxes have nothing to do with revenue. Our politicians have proved this empirically; if we want a government program or idea bad enough we will find any means to pay for it. This isn’t something new. Does anyone else remember the congressional check bouncing scandals of the 1990’s, or the constant acknowledgement that Social-Security is insolvent?

Our politicians instead use taxation as a billy club, a way to influence and control. The right would have us believe that tax policy should be used to change the economy, i.e. the George Bush tax rebate. The left would have us believe that taxes should be used to control economic fairness and correct inadequacies in our society. No doubt, taxes can influence both. But taxation and tax policy are NOT at the root of our problems. They neither caused our current economic predicament, nor our social failings. Using taxes in this way is merely an attempt to shove us around, or force others to “see it our way”.

The conversation around taxation has to change back to: Taxes exist to generate revenue to fund the government, allowing it to provide for the general welfare as guided by the U.S. Constitution. The conversation needs to change such that we begin to discuss the root causes of our economic and social problems, not all of which are related to policy. It needs to change such that band aid resolutions, like taxation policy changes, are not considered a permanent solution, or a solution of any kind.

This is only one example of the change needed. These aren’t new ideas, nor are they old and tired. Instead, it’s a return to the foundations of any lasting society: economic common sense, balance in powers, cultural responsibility and accountability.

These aren’t minority opinions. We don’t run our homes this way. We don’t run our businesses this way. We don’t run our churches this way. We don’t run our communities this way. It is time for the habitually silent majority to speak. It’s time for America to demand common sense and grounded, principled leadership.

It’s time for a change in the conversation.

You can read more about Josh Loveless as a candidate at www.facebook.com/joshlovelessforcongress